Free Net Worth Tracker for Google Sheets

Here's the thing about money: you can track every latte and still have no idea if you're actually getting ahead. That's where net worth comes in. It's the one number that tells you if all your financial decisions are moving you forward-or just keeping you busy.

This free Google Sheets template makes it easy to track your net worth over time. Add your accounts, see your totals, and watch the trend line. No complicated setup. No spreadsheet wizardry required.

What Is Net Worth (And Why Should You Track It)?

The Simple Definition

Net worth = what you own minus what you owe. That's it. Add up your bank accounts, investments, and property (your assets). Subtract your credit cards, loans, and mortgage (your liabilities). The number you're left with? That's your net worth-the clearest snapshot of your financial health.

Most people check their bank balance daily but calculate their net worth... never? Once a year? That's like focusing on the trees while missing the forest. This template helps you track net worth regularly so you can see the full picture-not just this week's spending.

What You Get

A Dashboard That Actually Makes Sense

Open it up and immediately see: your current net worth, how it's changed since last month, and what's driving the change. No hunting through tabs or deciphering formulas. Just the numbers that matter.

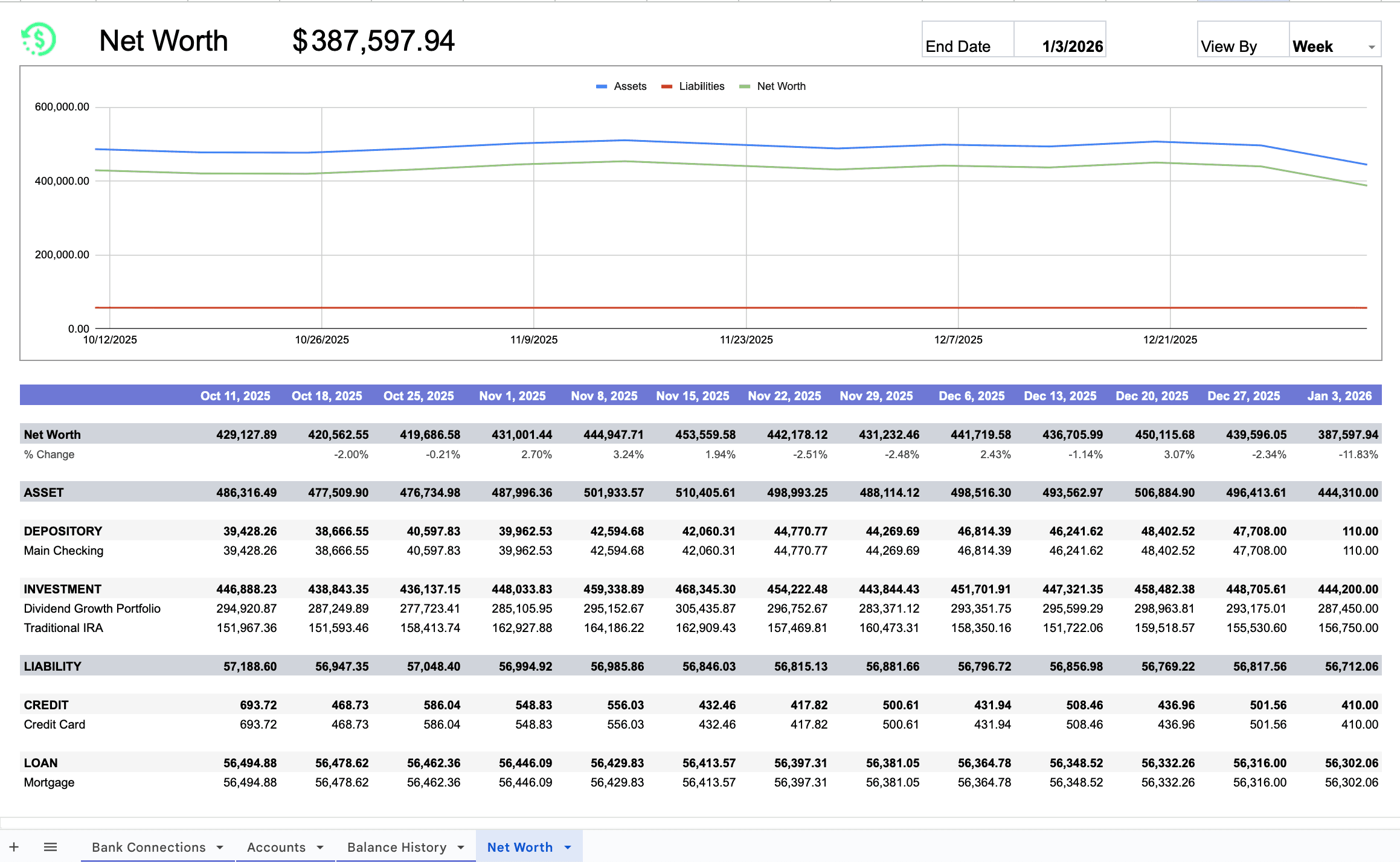

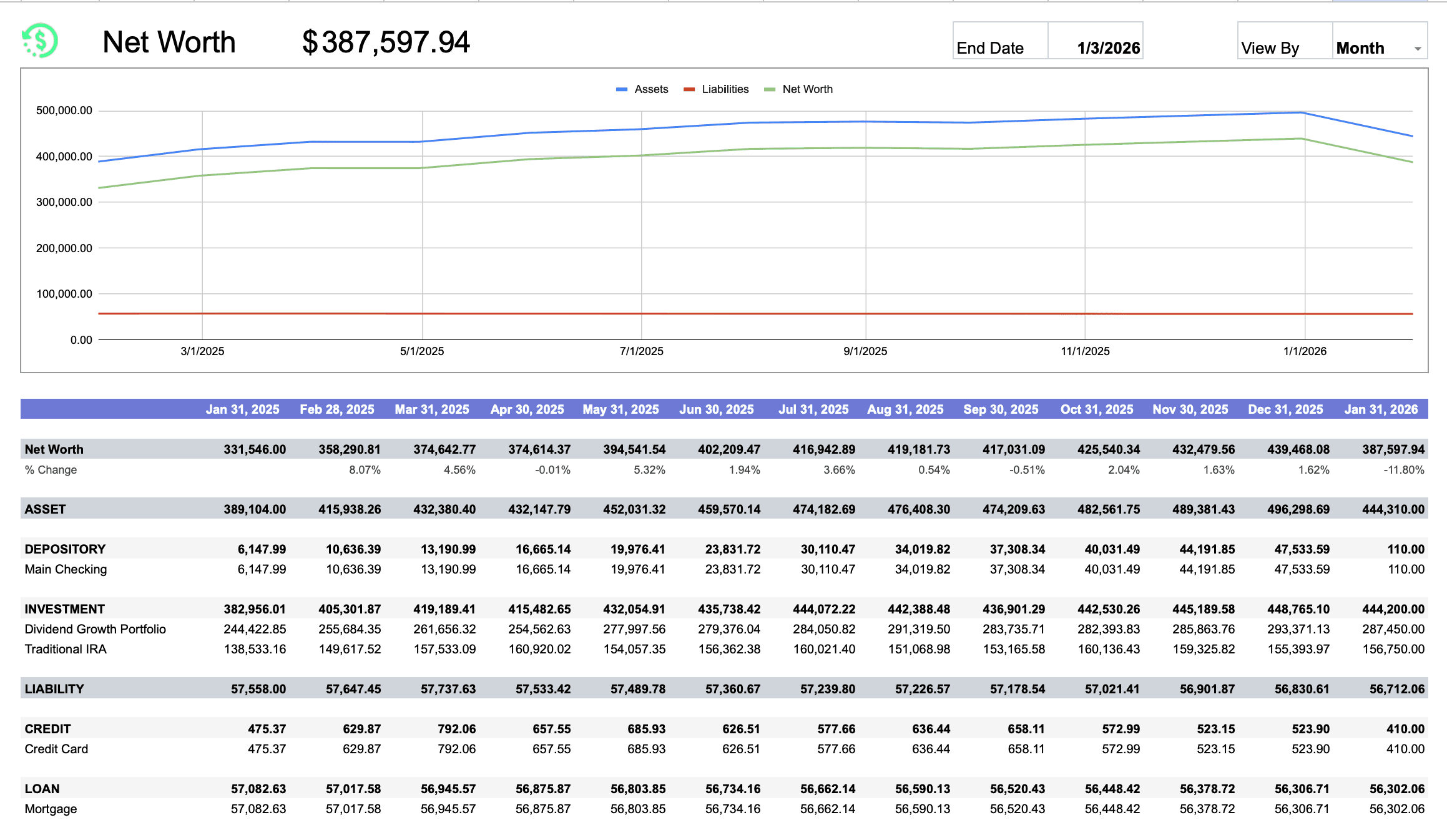

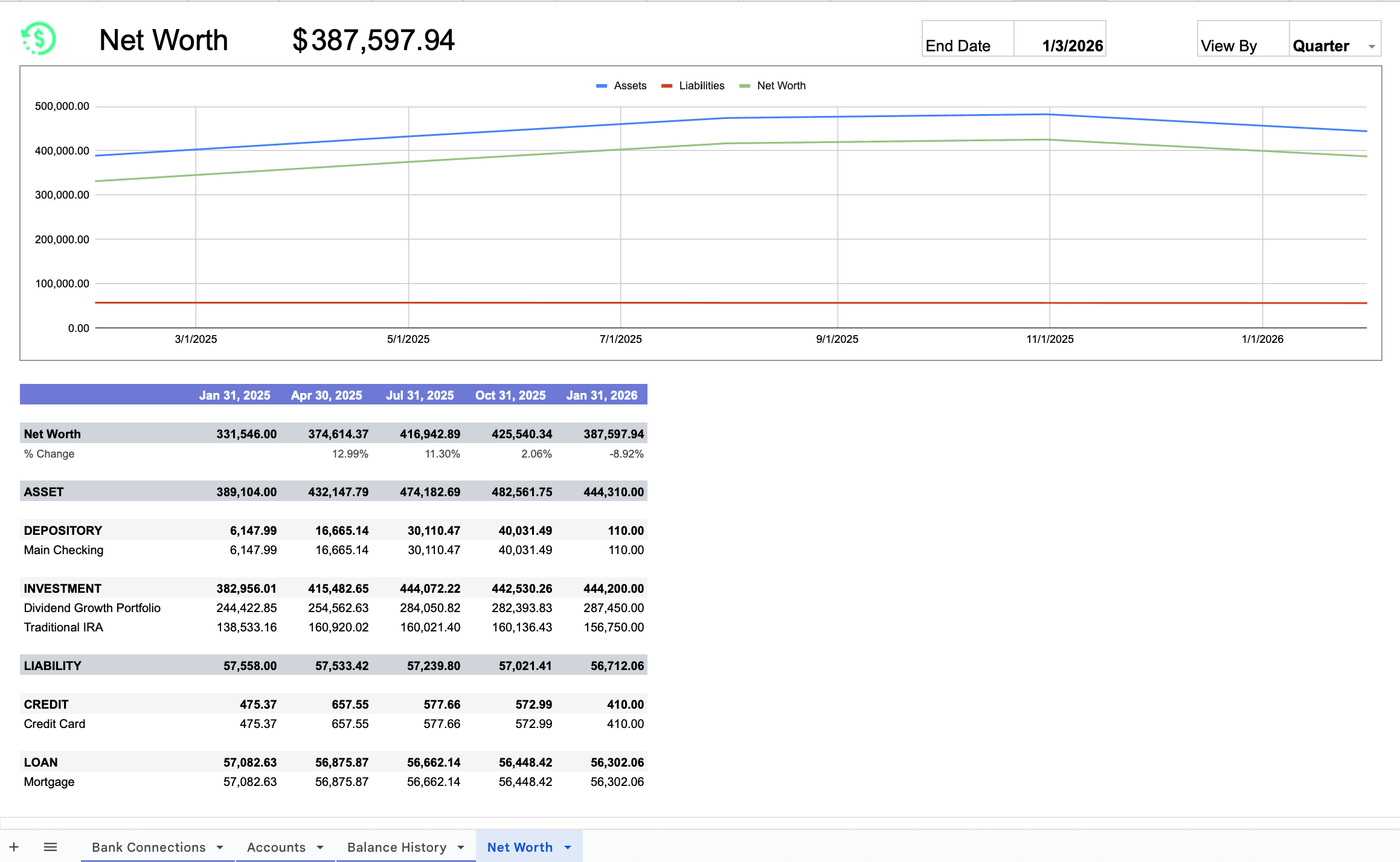

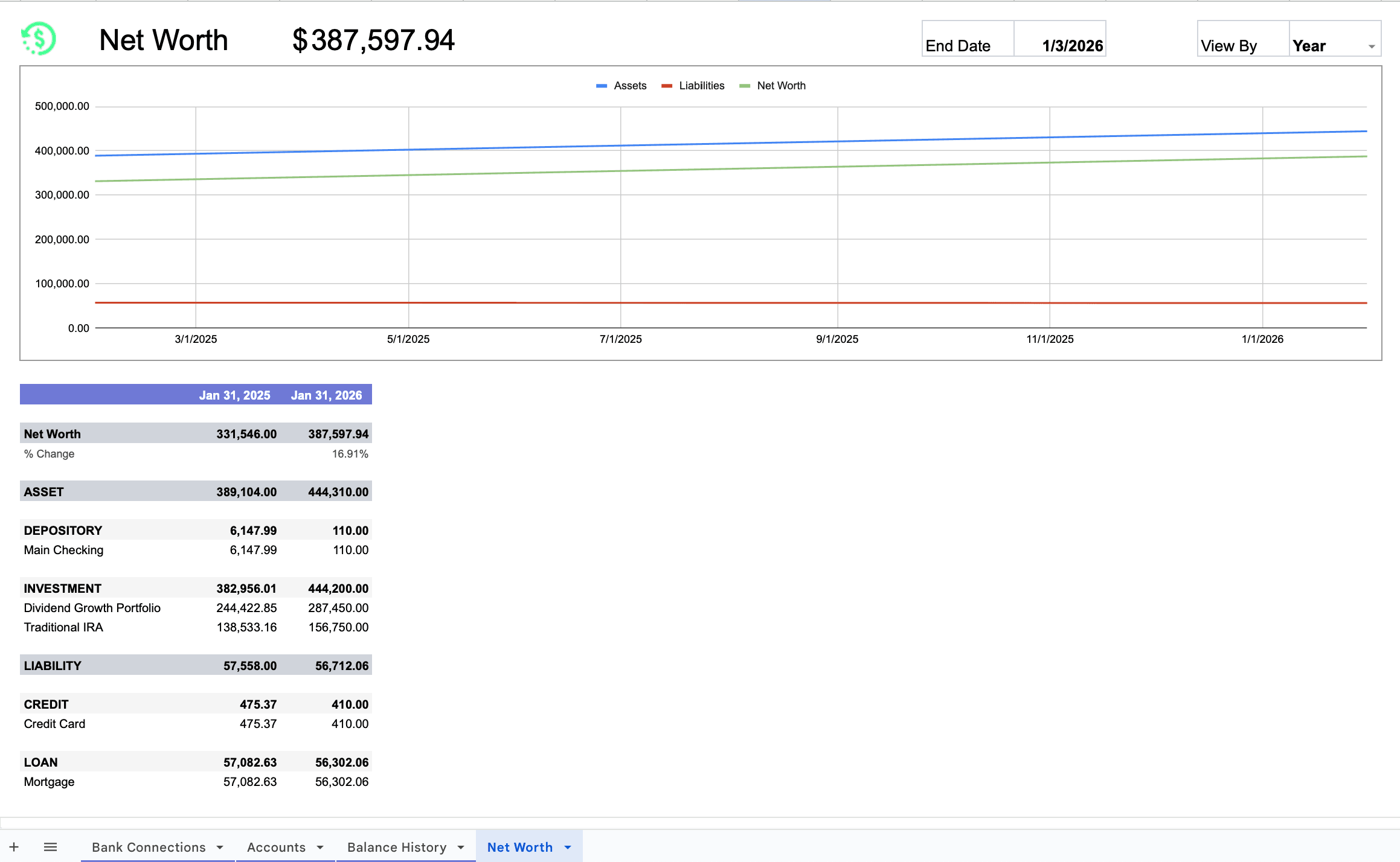

Charts That Show Your Progress

There's something satisfying about watching a line go up and to the right. The built-in charts track your assets, liabilities, and net worth over time. Pick your view-weekly, monthly, quarterly, or yearly-and see how far you've come.

Automatic Calculations

Enter your balances and let the spreadsheet do the math. It automatically sorts accounts as assets or liabilities, calculates your totals, and figures out your growth rate. You focus on the big picture; it handles the arithmetic.

A Place for Every Account

Bank accounts, 401(k), credit cards, mortgage, brokerage accounts-this net worth tracker spreadsheet has room for all of them. Organize by type, see where your wealth is concentrated, and spot accounts that might need attention.

Historical Tracking Built In

Want to see where you were six months ago? A year ago? The balance history sheet stores snapshots over time, so you can track trends and celebrate milestones. (Pro tip: looking back at old numbers is surprisingly motivating.)

How to Get Started

1 List Your Financial Institutions

Start by adding the banks, brokerages, and lenders where you have accounts. Think of it as building your financial rolodex.

2 Add Your Accounts

For each institution, list the specific accounts: checking, savings, retirement accounts on the asset side; credit cards, loans, and mortgages on the liability side. The more complete, the more accurate your picture.

3 Enter Your Current Balances

Pop in today's numbers. The template figures out the rest-categorizing accounts, adding up assets vs. liabilities, and calculating your net worth automatically.

4 Update Regularly

For manual tracking, once a month works great. Add new balance snapshots to the history sheet and watch your trend line develop. (Or skip the manual updates entirely with Finta-more on that below.)

5 Check Your Dashboard

Come back anytime to see where you stand. The net worth dashboard updates automatically as you add data, showing your progress and highlighting what's changed.

Want It to Update Itself? That's Where Finta Comes In

Manual tracking works, but let's be honest-life gets busy and spreadsheets get forgotten. Finta connects your bank accounts and investment accounts directly to Google Sheets, so your balances update automatically. Every day.

What Changes with Finta

Your balances stay current. No more logging into five different apps to copy numbers over. Finta syncs your accounts daily, so your net worth tracker always reflects reality. Your history builds itself. Every balance change gets recorded automatically. Come back in six months and see exactly how your wealth grew (or where it dipped) without having to remember to update anything. Your charts stay fresh. As new data flows in, your wealth trend charts update in real time. Watch your progress without lifting a finger.Accounts You Can Connect

If it has a balance, you can probably track it:

- Checking, savings, and money market accounts

- Investment accounts: brokerage, 401(k), IRA, HSA

- Credit cards and lines of credit

- Mortgages, auto loans, student loans

- Business bank accounts like Mercury and Brex

- Stripe account balances for online businesses

Why Bother Tracking Net Worth?

Who Uses a Net Worth Tracker?

Inside the Template

Net Worth

This is home base. At a glance: current net worth, period-over-period change, and a breakdown of assets vs. liabilities. Use the dropdown to switch between weekly, monthly, quarterly, and yearly views.

Bank Connections

A simple list of everywhere your money lives: banks, brokerages, credit unions, lenders. When using Finta, this populates automatically.

Accounts

Every account you own, organized by type:

- Depository: checking, savings, money market

- Investment: 401(k), IRA, brokerage, HSA

- Credit: credit cards, HELOCs

- Loan: mortgage, auto, student, personal

Balance History

Snapshots of your account balances over time. This is what powers your trend charts. Manual users update this periodically; Finta users get automatic daily entries.

How the Math Works

It's straightforward:

- Total Assets = all positive balances added up

- Total Liabilities = all debts added up

- Net Worth = Assets minus Liabilities

- Growth % = change from last period to this one

Everything updates automatically as you add data.

Real Ways People Use This

Building an Emergency Fund

Watching your net worth climb as your savings grow is satisfying in a way that checking your bank balance isn't. You can see it becoming a meaningful part of your wealth.

Crushing Debt

Every payment you make shrinks your liabilities and grows your net worth. It's the same progress, but visualized in a way that feels like winning.

Growing Investments

Market returns, dividends, new contributions-it all shows up in your net worth. See how regular investing compounds over months and years.

Making Big Purchase Decisions

Thinking about that home down payment or new car? See exactly how it'll affect your net worth before you commit.

Planning for Retirement

Set a target number and track your progress toward it. Adjust your savings rate based on real data, not guesswork.

Rebalancing Your Portfolio

When one asset class outgrows the others, you'll see it in the breakdown. Spot imbalances before they become problems.

Tips for Getting the Most Out of This

What Works

Ready to know exactly where you stand? Grab this free net worth tracker for Google Sheets and start seeing your complete financial picture. Your future self will thank you.